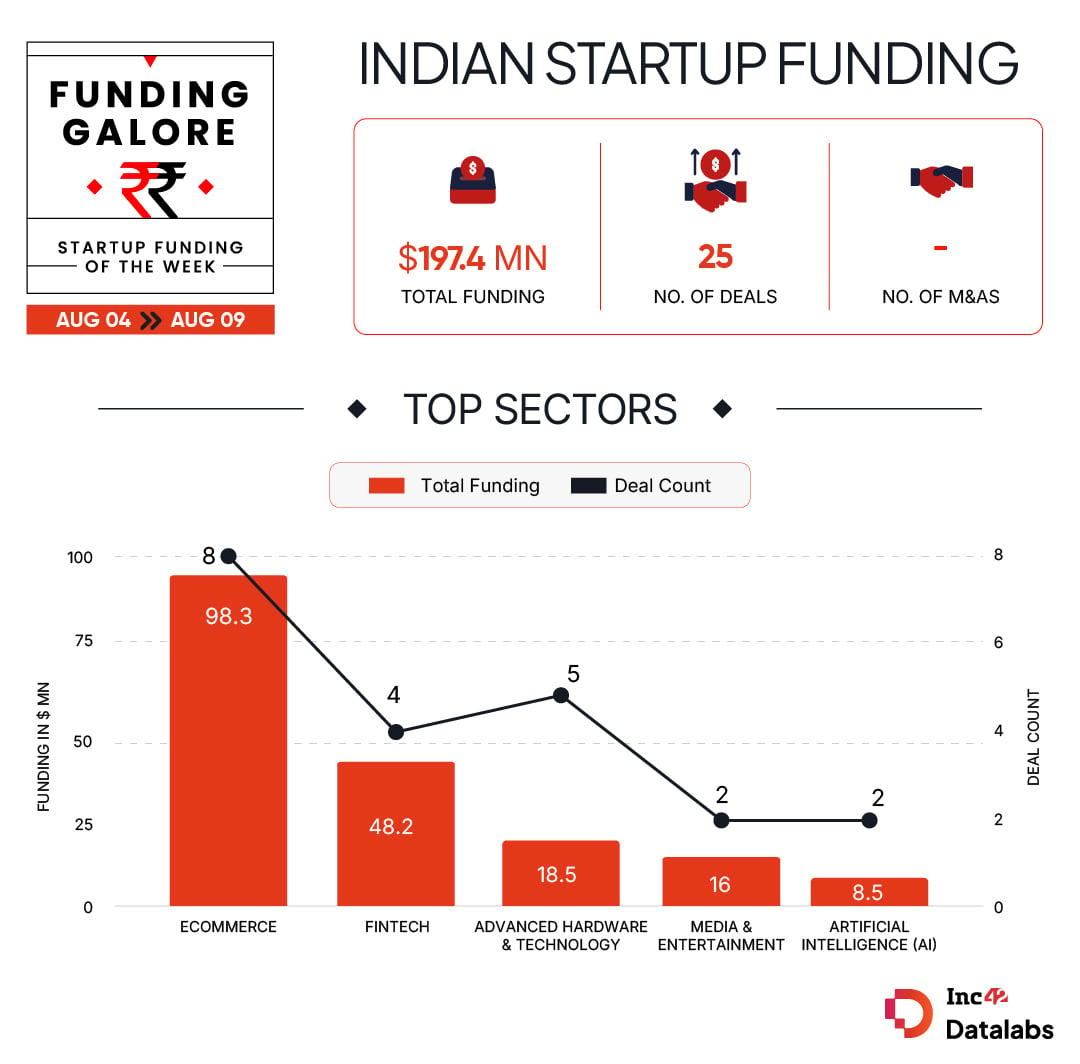

After a tepid month of funding, the Indian startup ecosystem has started showing signs of fresh life in August, backed by a host of early and mid-sized transactions. Investment activity between August 4 and 9 skyrocketed over 90% as 25 startups collectively raised $197.4 Mn. Last week, at least 14 startups garnered $103.7 Mn in total funding.

Funding Galore: Indian Startup Funding Of The Week [ Aug 4 – Aug 9 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 6 Aug 2025 | The Sleep Company | Ecommerce | D2C | B2C | $54.6 Mn | Series D | ChrysCapital, 360 ONE Asset | – |

| 7 Aug 2025 | RENEE Cosmetics | Ecommerce | D2C | B2C | $30 Mn** | Series C | Playbook Partners, Midas Capital | Playbook Partners |

| 5 Aug 2025 | Fibe | Fintech | Lending Tech | B2B | $25 Mn | Debt | Franklin Templeton Alternative Investments Fund | Franklin Templeton Alternative Investments Fund |

| 6 Aug 2025 | SuperGaming | Media & Entertainment | Gaming | B2C | $15 Mn | Series A | Skycatcher, Steadview Capital, a16z Speedrun, Bandai Namco 021 Fund, Neowiz and Web3 Investors, Polygon Ventures, Sandeep Nailwal, 4th Revolution Capital, 32-Bit Ventures, Ryze Labs, Ed3n Ventures, Visceral Capital, AET Japan, BACE Capital | Skycatcher, Steadview Capital |

| 5 Aug 2025 | Jeh Aerospace | Advanced Hardware & Technology | Aerial Vehicles | B2B | $11 Mn | Series A | Elevation Capital, General Catalyst | Elevation Capital |

| 6 Aug 2025 | Zype | Fintech | Lending Tech | B2C | $10.3 Mn | – | Unleash Capital Partners, Xponentia Capital Partners, Tejinder Singh Hara | Unleash Capital Partners |

| 6 Aug 2025 | DPDPZero | Fintech | Fintech SaaS | B2B | $7 Mn | Series A | GMO Venture Partners, India Quotient, Sinarmas Group, SMBC Asia Rising Fund, Blume Venture | GMO Venture Partners |

| 5 Aug 2025 | TurboHire | Artificial intelligence (AI) | Application Layer | B2B | $6 Mn | Series A | IvyCap Ventures | IvyCap Ventures |

| 4 Aug 2025 | Mitigata | Fintech | Insurtech | B2B | $5.9 Mn | Series A | Nexus Venture Partners, Titan Capital, WEH Ventures | Nexus Venture Partners |

| 6 Aug 2025 | TPlusA India | Ecommerce | D2C | B2C | $5.8 Mn | Seed | Livspace, Ramkant Sharma, Nishant Sharma | Livspace |

| 6 Aug 2025 | Cautio | Advanced Hardware & Technology | Internet Of Things (IoT) & Hardware | B2B | $3 Mn | Seed | 100Unicorns, Venture Catalysts, Antler India, Infinyte Club, PIEDS-BITS Pilani, Gajendra Jangid, Vikram Chopra, Amal Parikh, 8i Ventures, AU Small Finance Bank, Vibha Chetan, Venture Catalysts, Raveen Sastry, Vivekananda Hallekere, Nishchay AG | – |

| 7 Aug 2025 | OUTZIDR | Ecommerce | D2C | B2C | $3 Mn | Pre-Series A | RTP Global, Stellaris Venture Partners | RTP Global |

| 6 Aug 2025 | HYLENR | Clean Tech | Climate Tech | B2B | $3 Mn | Pre-Series A | Valour Capital, Chhattisgarh Investments | Valour Capital, Chhattisgarh Investments |

| 7 Aug 2025 | Zepto | Consumer Services | Quick Commerce | B2C | $2.9 Mn | – | MapmyIndia | MapmyIndia |

| 6 Aug 2025 | CodeKarma | Artificial intelligence (AI) | Application Layer | B2B | $2.5 Mn | Pre-Seed | Prosus, Accel, Xeed Ventures, SenseAI Ventures, Stargazer Ventures | Prosus, Accel, Xeed Ventures |

| 7 Aug 2025 | Xovian Aerospace | Advanced Hardware & Technology | Space Tech | B2B | $2.5 Mn | Pre-Seed | Piper Serica, Turbostart, Inflection Point Ventures, Eaglewings Ventures | Piper Serica, Turbostart |

| 7 Aug 2025 | Nuuk | Ecommerce | D2C | B2C | $2 Mn* | Series A | Vertex Ventures SEA, Good Capital | – |

| 6 Aug 2025 | DesignX | Enterprise Tech | Horizontal SaaS | B2B | $2 Mn | – | Rockstud Capital, We Founder Circle, Piper Serica | – |

| 5 Aug 2025 | EON Space Labs | Advanced Hardware & Technology | Spacetech | B2B | $1.2 Mn | Pre-Series A | MGF Kavachh, HHV Advanced Technologies | MGF Kavachh |

| 7 Aug 2025 | MangoPoint | Ecommerce | D2C | B2C | $1 Mn | Pre-Series A | Inflection Point Ventures, The Chennai Angels, Native Angel Network, Keiretsu Forum India, Fondation Botnar, IIM-CAN, Metis Family Office, JITO Incubation and Innovation Foundation | Inflection Point Ventures |

| 5 Aug 2025 | Fraganote | Ecommerce | D2C | B2C | $1 Mn | Pre-Series A | Rukam Capital | Rukam Capital |

| 5 Aug 2025 | Shortgun Games | Media & Entertainment | Gaming | B2C | $1 Mn | Seed | – | – |

| 6 Aug 2025 | Gladful | Ecommerce | D2C | B2C | $913K | – | Eternal Capital, Antler India, Venture Catalysts, RWA Advisors, Arav Ventures, Aman Tekriwal, Sairam Krishnamurthy | Eternal Capital |

| 5 Aug 2025 | Terafac | Advanced Hardware & Technology | Robotics | B2B | $800K | Pre-Seed | Inuka Capital, DeVC, Bharat Founders Fund, Innovation Mission Punjab | Inuka Capital |

| 5 Aug 2025 | Prozo | Logistics | Shipping & Delivery | B2B | – | – | Ranbir Kapoor | Ranbir Kapoor |

| Source: Inc42 *Part of a larger round ** Includes secondary transactions Note: Only disclosed funding rounds have been included |

- Ecommerce eclipsed every other startup sector in terms of weekly funding this week, gobbling up about 50% of the cumulative fresh capital infusion in the world’s third-largest startup ecosystem. Eight ecommerce startups bagged $98.3 Mn this week.

- The D2C sub-sector accounted for the entire ecommerce funding allocation this week, with mattress brand The Sleep Company mopping up the biggest $54.6 Mn Series D cheque.

- The advanced hardware and technology sector recorded the second-highest number of deals, with startups collectively pulling in $18.5 Mn.

- The week also saw a clutch of VC firms, including Antler India, Venture Catalysts, Piper Serica and Inflection Point Ventures, among others, picking up investment activity with each backing two startups.

- This week, seed funding raked in $9.8 Mn across six deals, marking a 36% uptick from the preceding week.

- Joining the growing list of new-age tech startups moving towards the bourses, jewellery brand BlueStone filed its IPO papers this week. The company has trimmed its fresh issue size from INR 1,000 Cr to INR 820 Cr. Besides, its existing investors reduced the size of the OFS component to 1.4 Cr shares from 2.4 Cr shares earlier.

- Reliance Industries Limited (RIL) officially wrote off its entire $200 Mn investment in defunct hyperlocal delivery startup Dunzo.

- Peak XV Partners CPO Anuj Sahai stepped down after two years at the VC firm. This comes in continuation of a string of senior exits from India’s largest venture capital fund.

- Adding to Zepto’s bid to add more domestic shareholders to its captable, the quick commerce major added geotech major MapmyIndia to its captable this week.

The post From The Sleep Company To Jeh Aerospace — Indian Startups Raised $197 Mn This Week appeared first on Inc42 Media.

You may also like

'You are welcome': Major outrage over Birmingham making 5-year-olds write Valentine's Day cards to asylum seekers

Under whose pressure did PM halt military operation, asks Cong

Riot police brace for more protests as nationwide day of anger sparks arrests

Defence production has soared to an all-time high of 1.5L cr, says Rajnath Singh

The 1% Club host Lee Mack forced to apologise after "harsh" player comment