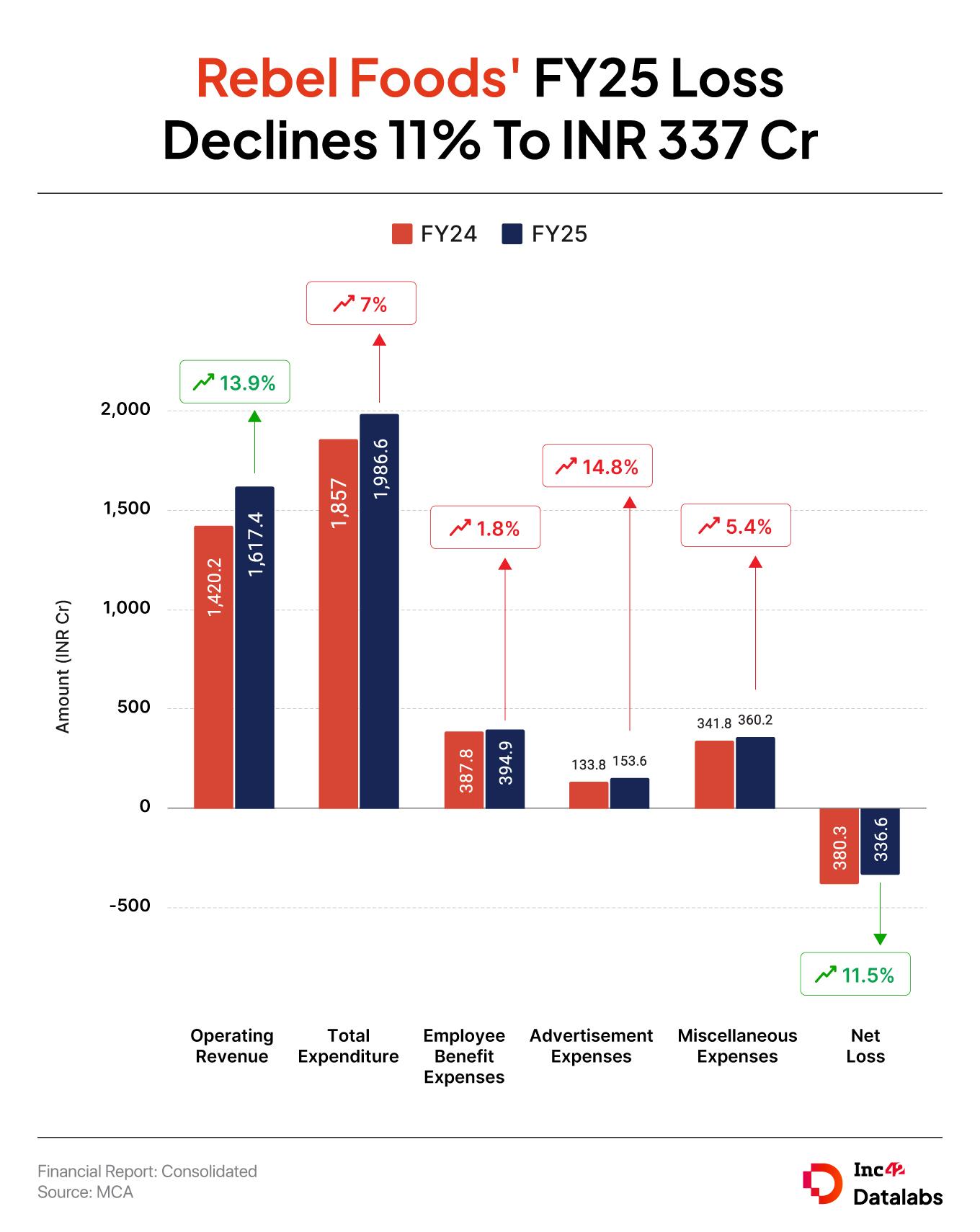

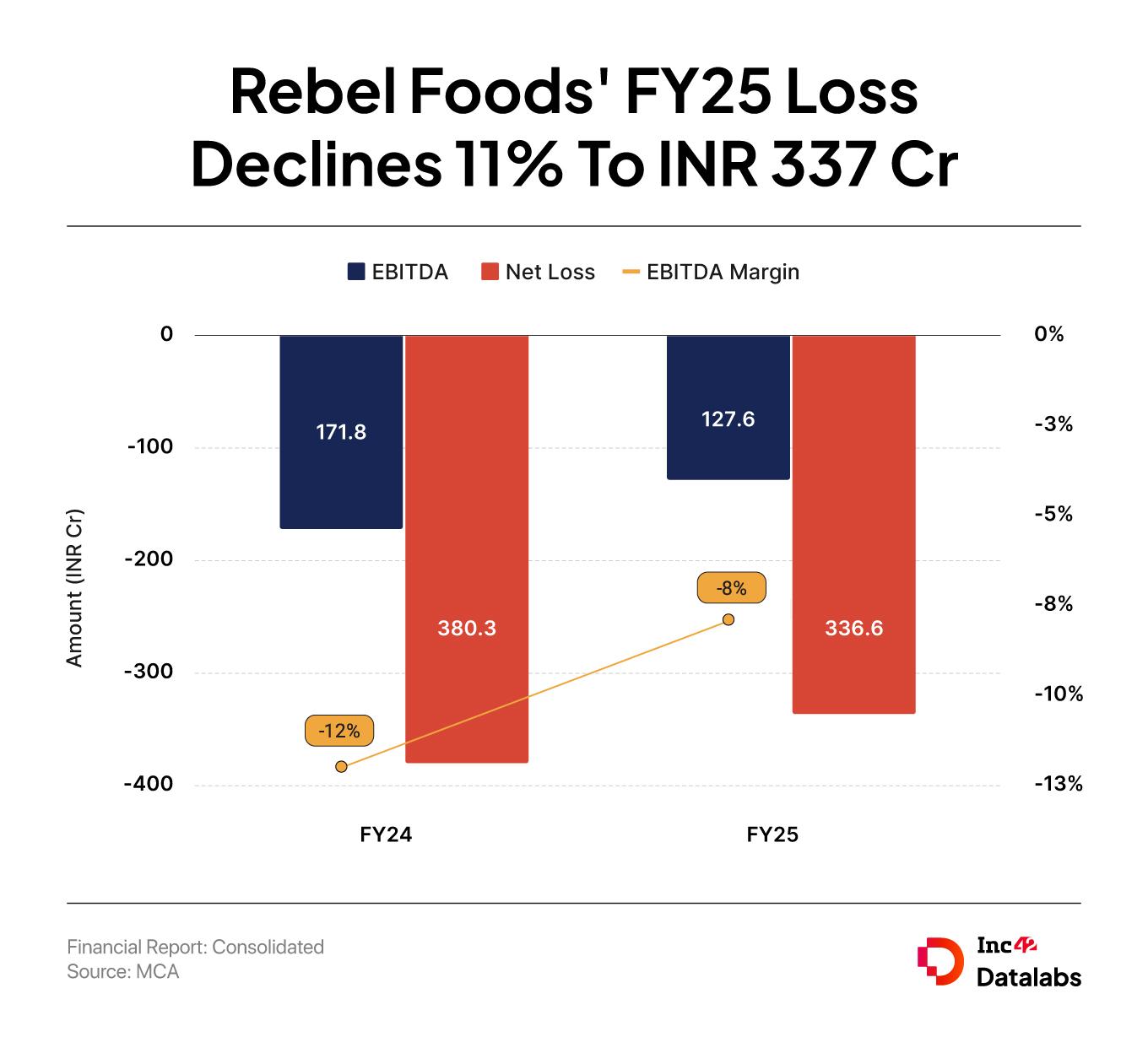

Cloud kitchen startup Rebel Foods reported a net loss of INR 336.6 Cr in the financial year ended March 2025 (FY25), down 11.5% from INR 380.3 Cr in the previous fiscal year, due to improvement in margins.

The startup’s operating revenue zoomed 13.9% to INR 1,617.4 Cr during the year under review from INR 1,420.2 Cr a year ago. Total income increased 11.6% to INR 1,657.9 Cr from INR 1,485.5 Cr in FY24.

The rise in revenue was driven mainly by stronger product sales. Revenue from sale of products rose 14% to INR 1,565.3 Cr from INR 1,373.7 Cr in FY24, while service revenue increased slightly to INR 32.62 Cr in FY25 from INR 31.09 Cr.

The startup also reported INR 19.5 Cr in revenue from financial services, up 26.6% from INR 15.4 Cr last year. Rebel Foods lists its revenue from the delivery services under the financial services segment.

EBITDA loss reduced 25.7% to INR 127.6 Cr from INR 171.8 Cr EBITDA loss in the previous fiscal. EBITDA margin also improved 400 basis points (bps) to -8% from -12% in the year ago period.

Notably, Rebel Foods is now expanding beyond its cloud kitchen business. In February, the startup forayed into the 15-minute food delivery segment with its new app QuickiES, taking on similar offerings from Zomato’s Blinkit Bistro and Swiggy’s SNACC.

QuickiES is currently live in select locations in Mumbai and delivers from 45+ brands, including Faasos, Wendy’s, Oven Story Pizza and LunchBox.

In July, the startup also saw a major leadership reshuffle. Its cofounder and India CEO Ankush Grover was elevated to the role of global CEO, while cofounder Jaydeep Barman moved into the role of chairman and group CEO.

All core functions now report directly to Grover as the startup targets an IPO in FY26.

In April, Rebel Foods reportedly secured $25 Mn (INR 212.71 Cr) from Qatar Investment Authority at a valuation of $1.4 Bn to expand its physical restaurants and food courts.

The startup, which began in 2011 with a single brand Faasos, now operates over 350 kitchens across 70 cities, serves 2.5 Lakh orders daily, and runs international kitchens in Dubai and the UK.

Rebel Foods has raised about $773 Mn to date from investors such as Temasek, KKR, Coatue, Lightbox and Peak XV Partners.

Rebel Foods’ expenses rose 7% to INR 1,986.62 Cr in FY25 from INR 1,857.03 Cr in the previous year, driven by higher material and advertising costs and other operating expenses.

Employee Benefit Expenses: The startup’s spending on employee costs rose 1.8% to INR 394.9 Cr during the year under review from INR 387.8 Cr in FY24.

Advertising & Promotional Expenses: The expenses under this head increased 14.8% to INR 153.6 Cr from INR 133.8 Cr in previous fiscal.

Miscellaneous Expenses: Miscellaneous expenses went up 5.4% to INR 360.2 Cr from INR 341.8 Cr in FY24.

The post Rebel Foods FY25: Loss Decines 11.5% To INR 337 Cr appeared first on Inc42 Media.

You may also like

When is LeBron James coming back? NBA legend's steady resurgence sparks hope as Los Angeles Lakers await his powerful comeback

K'taka: Kumaraswamy slams Cong govt over Bidadi Township Project, backs farmers

Veteran actress Sulakshana Pandit passes away at 71

No caste-based politics; need jobs, education in Bihar: First-time voters in Patna

Bihar Polls: Deputy CM Sinha says "goons of RJD" attacked his convoy in Lakhisarai; RJD calls it "petty antics"